Last week, we published a blog post that talked about the problems in the UK savings market and our ambitions to tackle these problems. We said we’d do it by creating a marketplace of several savings partners.

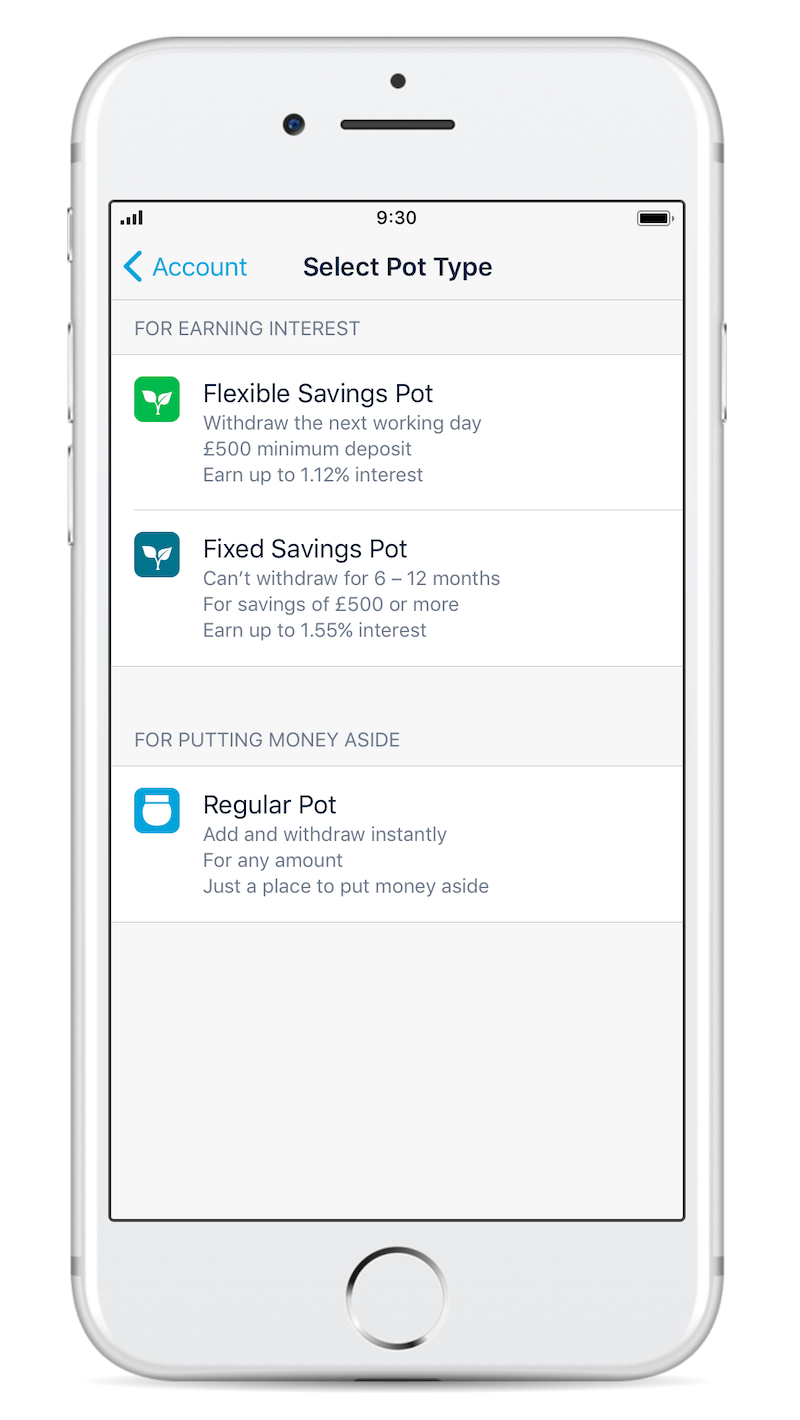

Our Savings Pots are set up to help customers access competitive interest rates in a simple and transparent way. We’ve made it really easy for you to open and move money into a Savings Pot that earns interest, without needing to go through the painful admin that comes with opening a new savings account elsewhere.

We've made flexible Savings Pots available again with our third provider, Shawbrook! 🎉

Today, we’re excited to announce that Shawbrook has joined our marketplace - our third savings provider available through the Monzo app, along with OakNorth and Investec.

Savings Pots with Shawbrook have an interest rate of 1.12% AER and a minimum deposit of £500. And we'll be rolling them out gradually starting next week.

This means a wider selection of savings products available through Monzo, as well as the return of our Flexible Savings Pots (which we had to pause earlier this year). Shawbrook also offers the best rate in the Monzo marketplace on Flexible Savings Pots today.

We’ve listed out all the products and rates that are now available on the growing Monzo savings marketplace:

| Savings Pot type | Main features | Annual Equivalent Rate (AER) |

|---|---|---|

| Flexible | You can add or withdraw money any time you like. If you withdraw, you’ll get the money back within one working day. And you need at least £500 to open one. |

|

| Flexible ISA | With an ISA, you can save money without paying tax on the interest you earn. You can pay up to £20,000 into an ISA this tax year. And you need at least £500 to open one. Find out more about how ISAs work in our guide. |

|

| Fixed Term | Fixed Term Savings Pots pay different interest rates, depending on how long you choose to put your money away for. You can’t add or withdraw any money from these Pots until that time is over. And you need at least £500 to open one. |

12 months:

9 months:

6 months:

|

We'll start making Savings Pots with Shawbrook available starting next week, so don't worry if you can't see them yet. You’ll be able to find these savings products, and all the others, in the Account tab:

Just so you know, we earn 0.2% commission from our savings partners.

Your money’s protected by the FSCS

Any money you put in a Savings Pot (including a cash ISA) is covered by the Financial Services Compensation Scheme (FSCS). That covers £85,000 across any savings you have with Shawbrook through your Monzo account, as well as any money you’ve deposited at Shawbrook directly.

Any money in your main Monzo account is also protected up to £85,000 by the FSCS, separately to your savings.

You can read more about how FSCS protection works here.

Here’s what we’re planning next

Over the next few months, we’ll be adding more savings partners, as well as exploring new improvements to help you save in a way that suits you.

Some of the ideas we’re exploring include:

quicker access to your savings (at the moment Flexible Savings Pot withdrawals take up to one working day)

the ability to set up rules that help you to build up your savings (for example, sweeping any unspent money at the end of the month into a Savings Pot that earns interest)

customised fixed term deposit lengths (because you might want to save for a special occasion in a couple of months and banks’ traditional term lengths just don’t suit you!)

We’d love to hear your thoughts about our plans, as well as any other ideas for how to improve savings. Just share your feedback in our community!

We’re really excited about the next few months. Watch this space! 👀