1. Use Pots to set money aside for different things

Pots are a simple way to set money aside, away from your main account. They help you save and organise your money in a way that fits in with your life.

Create multiple Pots for different purposes, and add money to each of them. You can use Pots to work towards all your savings goals, big and small – whether you’re preparing for a rainy day, planning a holiday, or saving up for a treat.

Just head to the Account tab in your app to create a new Pot, or tap the button below on your phone.

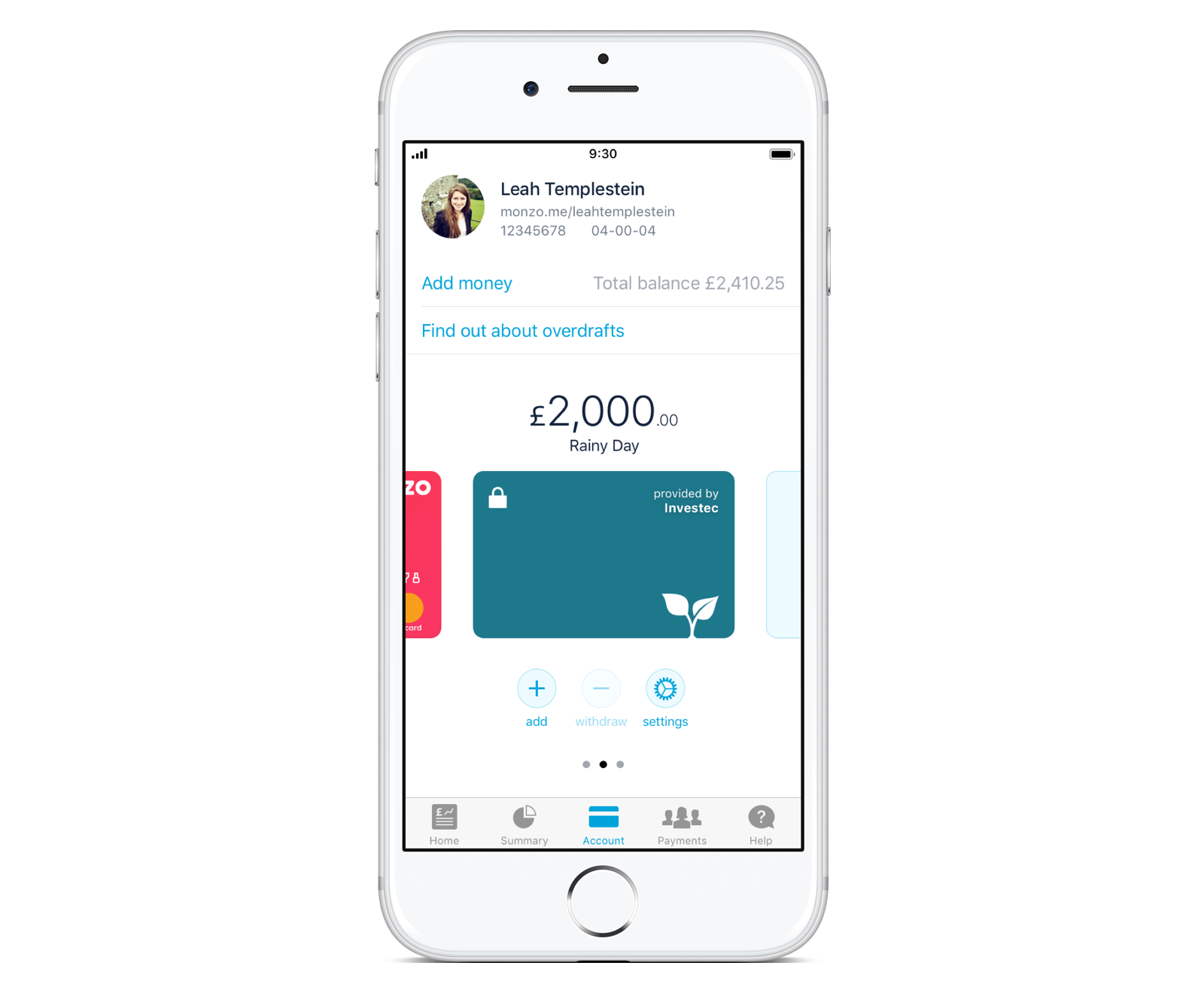

2. Earn interest on your savings

We’re partnering with other banks to help you earn interest on your savings through Monzo. The current interest rates are always available on our Savings page.

Set up Savings Pots from your Account tab to see your savings grow and manage them through Monzo.

3. Set goals and work towards them

When you create a new Pot (or edit an existing one), you’ll see the option to set a goal for your Pot. If you’re saving up for something specific, add the amount you need there.

The progress bar will show you how you’re getting on, and we’ll help you celebrate once you’ve reached your goal!

4. Lock Pots to stop yourself dipping into your savings

If you always find yourself dipping into your savings when you shouldn’t, try locking your Pots.

If you try to take money out of a locked Pot, we’ll double check that’s what you really want to do. The idea is that a little extra friction might help you think twice before taking a tenner out of your savings!

If you’re still tempted to dip into your savings when you don’t need to, you could even try using your guilt to your advantage with a little trick based on behavioural science.

Researchers in India found that having visual reminders of your savings goals actually stops you from dipping into them. So why not try setting up a Pot and putting an image of your goal on it? If you’re saving for a family holiday, add a photo from your last one. Use photos to remind yourself of your long-term goals.

Love it @monzo a little reminder why I need to save 😁 pic.twitter.com/7SNMHj4vW1

— Beth Romais 🏴 (@FPS_Beth) March 16, 2019

5. Pay yourself first

Paying yourself first is a popular strategy for saving. It means as soon as you get paid, before you spend money on anything else, pay a portion of your salary into savings first.

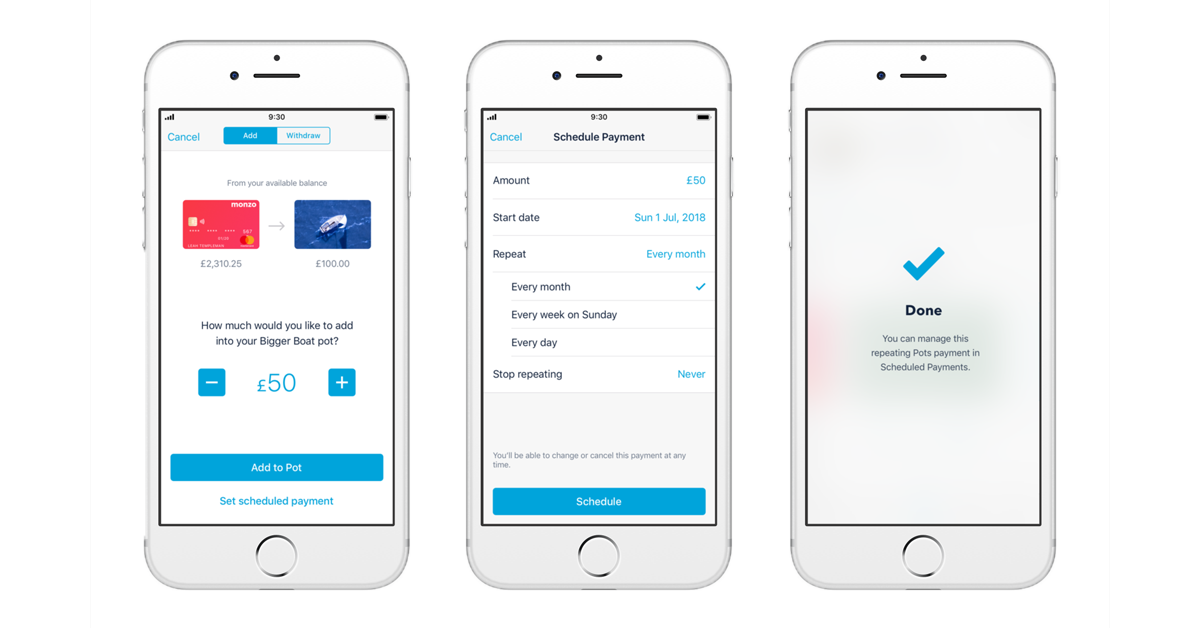

You can remember do this manually, or set up a payment on the day you get paid to automatically move money into a Pot.

Just tap the Pot you want to pay into and tap '+' to add money. You’ll see the option to set up a scheduled payment, then just pick your payday and tap 'Schedule'! We’ll move the money into your savings automatically on the days you’ve set.

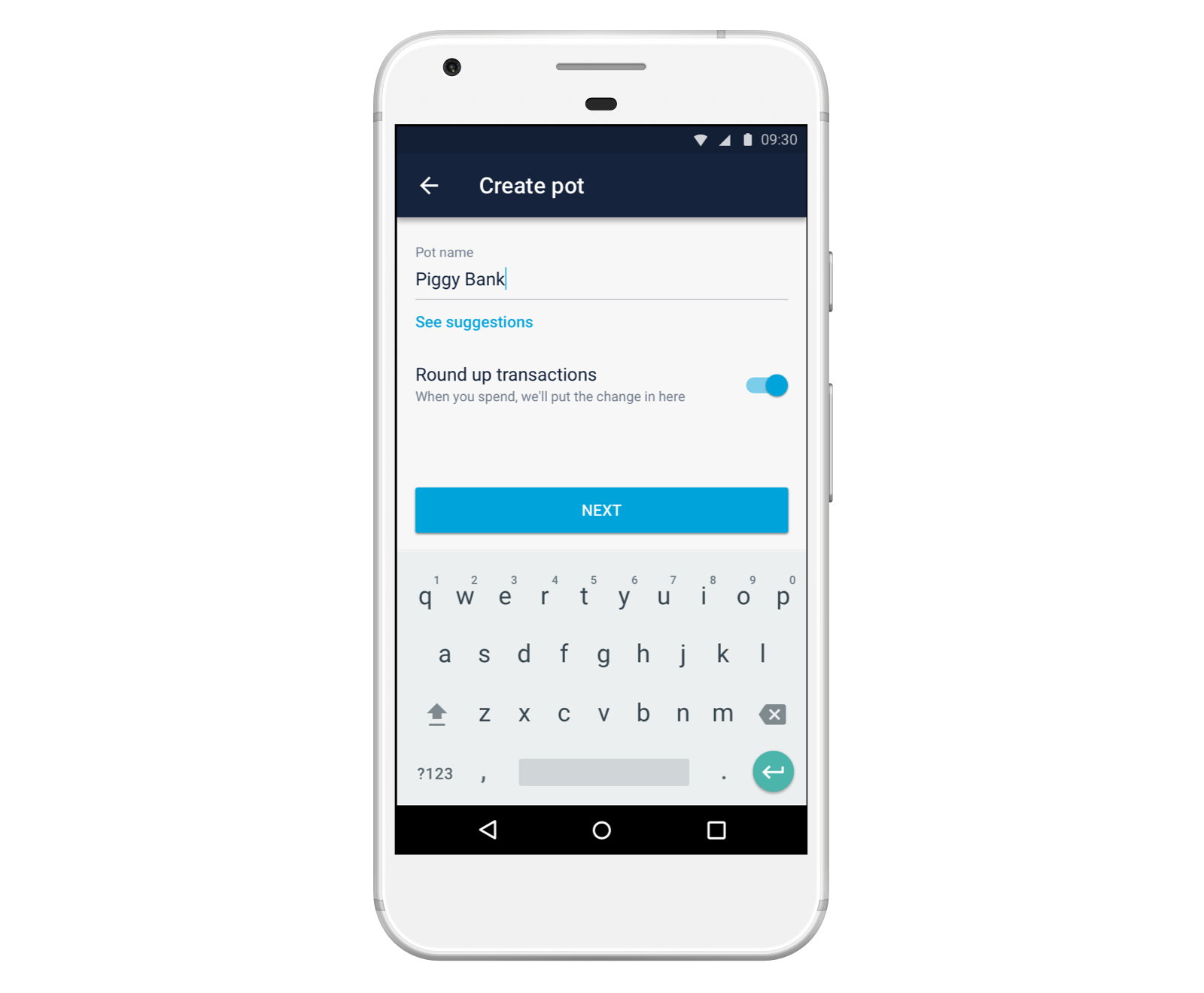

6. Round up your transactions and save the spare change

Whenever you buy something with Monzo, you can round up your purchases to the nearest pound and put the spare change in a Pot. This is a saving strategy sometimes known as ‘skimming.’

Round up your transactions by heading to the Account tab in your app. Create a Pot (or edit an existing one) and turn on the switch to ‘Round up transactions’.

If you want to start smaller, you can round up your purchases to the nearest 50p or 10p instead, through our integration with automation platform If This, Then That (IFTTT).

Use Monzo to round up your purchases and set the spare change aside.

UK residents only, Ts&Cs apply

7. Save little and often

'Little and often’ lets you build regular saving habits into your life. And means over time you’ll see pennies add up into something more significant.

Rounding up your transactions is a great way to get started! Or you could consider taking on a savings challenge like the 1p Savings Challenge or the 52 Week one.

They involve saving small amounts of money every day or every week, and gradually increasing the amount you’re setting aside. The idea is that you’ll start off saving small amounts you won’t miss, then build up momentum until your savings have added up to hundreds or even thousands of pounds.

Skint Dad's 2018 1p Savings Challenge 😎

Not only is it an easy way to save; if you manage to complete to whole 365 days of savings, you'll have a tidy sum of £667.95 saved 😮

Happy savings & a very happy New Year! 😁

pic.twitter.com/r6LiAlIQNn— Skint Dad (@SkintDad) January 1, 20188. Punish yourself for bad behaviour (or reward yourself for good!)

You can set up your Monzo account to move money around based on different rules (called “Applets”), through our integration with automation platform IFTTT. You can get creative and make your own rules, but our community have already come up with lots of great ones!

Why not save as you run or cycle with Strava? This Applet saves 1p for every 10 meters you run.

You could also try taxing yourself whenever you buy fast food and setting the money aside in a Pot. Or even penalise yourself for profanity by setting up a virtual swear jar.

9. Save whenever it rains (and other silly hacks)

IFTTT lets you save based on lots of different triggers. So if you’re looking for more fun ways to save, try experimenting!

This rule helps you save money for a holiday whenever it rains, but the possibilities are endless. You could try saving money every time you tweet, or whenever the International Space Station passes over your house.

Have we missed anything? Share your methods for using Monzo to save money in our community ❤️

Download Monzo to try these techniques for saving!