We're on a journey to fix all the painful and time-consuming things about managing your business finances, so that you can focus on running your business. And today, we're announcing an update that'll make budgeting for your business with Monzo even better.

We'll keep adding new things to our accounts all the time - check out our roadmap and vote for your favourite upcoming features.

New categories, especially for business

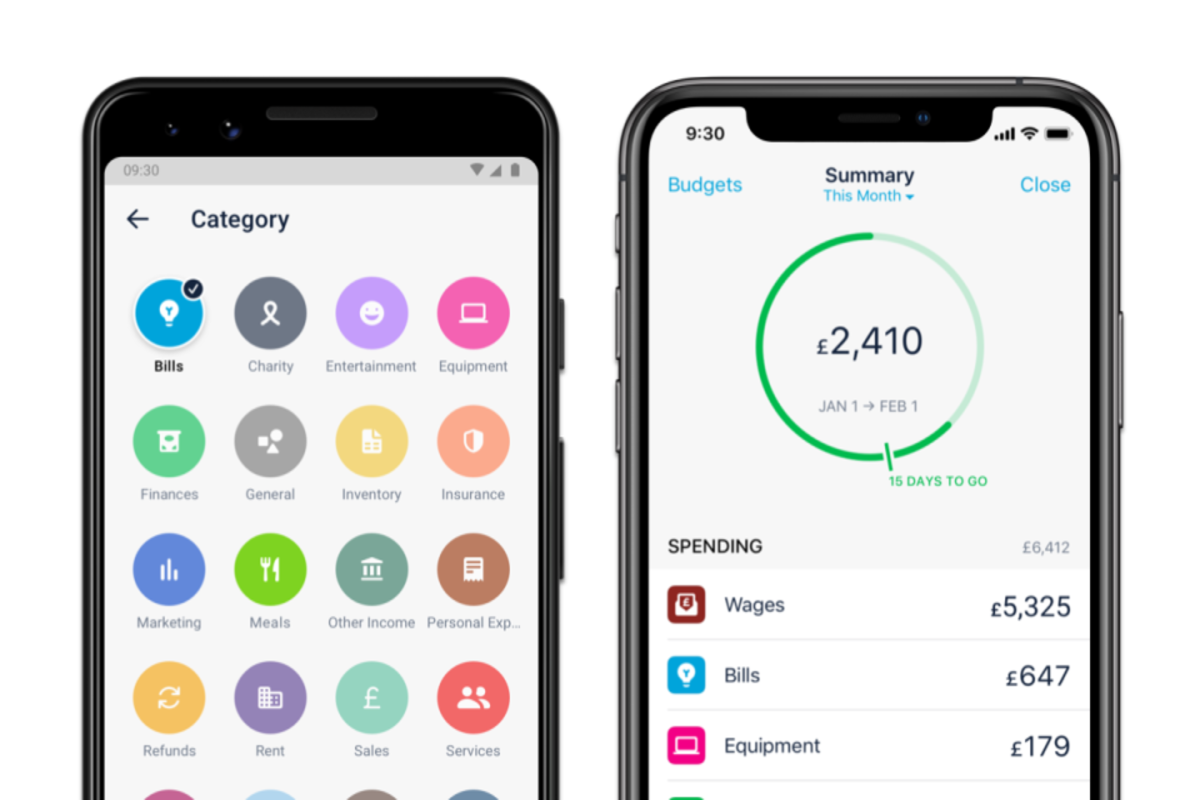

We've updated business categories to give you more clarity over where your money's going and coming in. They'll help with better budgeting - which is more important than ever during coronavirus, as many of you see your budgets stretched more than usual.

We've introduced 14 new business categories, to help you sort your expenses and income better. They include brand new income categories, like Sales and Services. And we've improved spending categories to cover more allowable expenses, like Wages, Inventory, Supplies, Tax and Equipment.

They've replaced some of the default spending categories that aren't usually expensed through a business account, like Holidays and Personal Care.

Categories are designed to help you better manage your cashflow, by giving you better visibility over your expenses and income, and over who's spending what. More relevant business categories will improve your in-app Summary experience, and make it more effective to set spending targets for each category using the Budgets feature.

You'll also be able to see the categories when you log in on the web. And if you do your reconciling manually, you'll now be able to see these new categories when you export your transactions into a CSV, setting you up for more seamless bookkeeping.

What's next for categories?

We're excited about these new categories, because they lay the foundation for what we'd like to do in the future. We want to keep improving transactions so that they reconcile automatically in your accounting tool. And one of our long-term goals is to have our categories better match up with HMRC categories too, like Allowable Expenses to make submitting self-assessments more straight forward, and to help you better understand how much VAT you owe or are owed.

We want to hear from you

We'd love to know what you think of the new categories, and what you'd want to see next. Make sure to join our Facebook community, tweet us @MonzoBusiness or vote for your favourite features on our public roadmap.

Monzo Business accounts help you manage your business finances stress-free. Know when you’ve been paid immediately with instant notifications, and and choose a percentage to save for your taxes automatically with Tax Pots.

On your mobile? Tap below to apply.