The government’s regulatory changes to the UK VAT system, known as ‘Making Tax Digital’, are just around the corner! We’ve rounded up everything you need to know before 1 April 2022 to help you feel in control 🧾

Making Tax Digital is designed to make managing your taxes easier

It’s a regulatory change that used to apply to some VAT-registered businesses, but now applies to all VAT-registered businesses, unless exempt. You’ll need to maintain digital records, prepare VAT returns using the information in those digital records, and submit them online through HMRC compliant software.

Less paperwork and more automation should mean it’s simpler for businesses to get their VAT returns right, without having to do lots of manual work 🙌

As of 1 April 2022, HMRC will only accept VAT returns that are sent using software which supports Making Tax Digital for VAT

So you’re only affected by this change if you still keep paper receipts and manual VAT records. And if you’re a business with a taxable turnover over £85,000, you’ll have already started doing this in April 2019 – so you’re probably a pro already 💻

You’ll need to digitise your records & VAT return to comply

You’ll need to keep digital records of transactions, and submit digital VAT returns through Making Tax Digital compatible software. And you’ll need to make sure all VAT payments are made before the deadline, to avoid any potential penalties.

The deadline relates to the first VAT period start date on or after 1 April 2022. So for example, if your previous VAT quarter was 1 March 2022 to 31 May 2022, then your first VAT quarter under new Making Tax Digital rules would be 1 June 2022 to 31 August 2022.

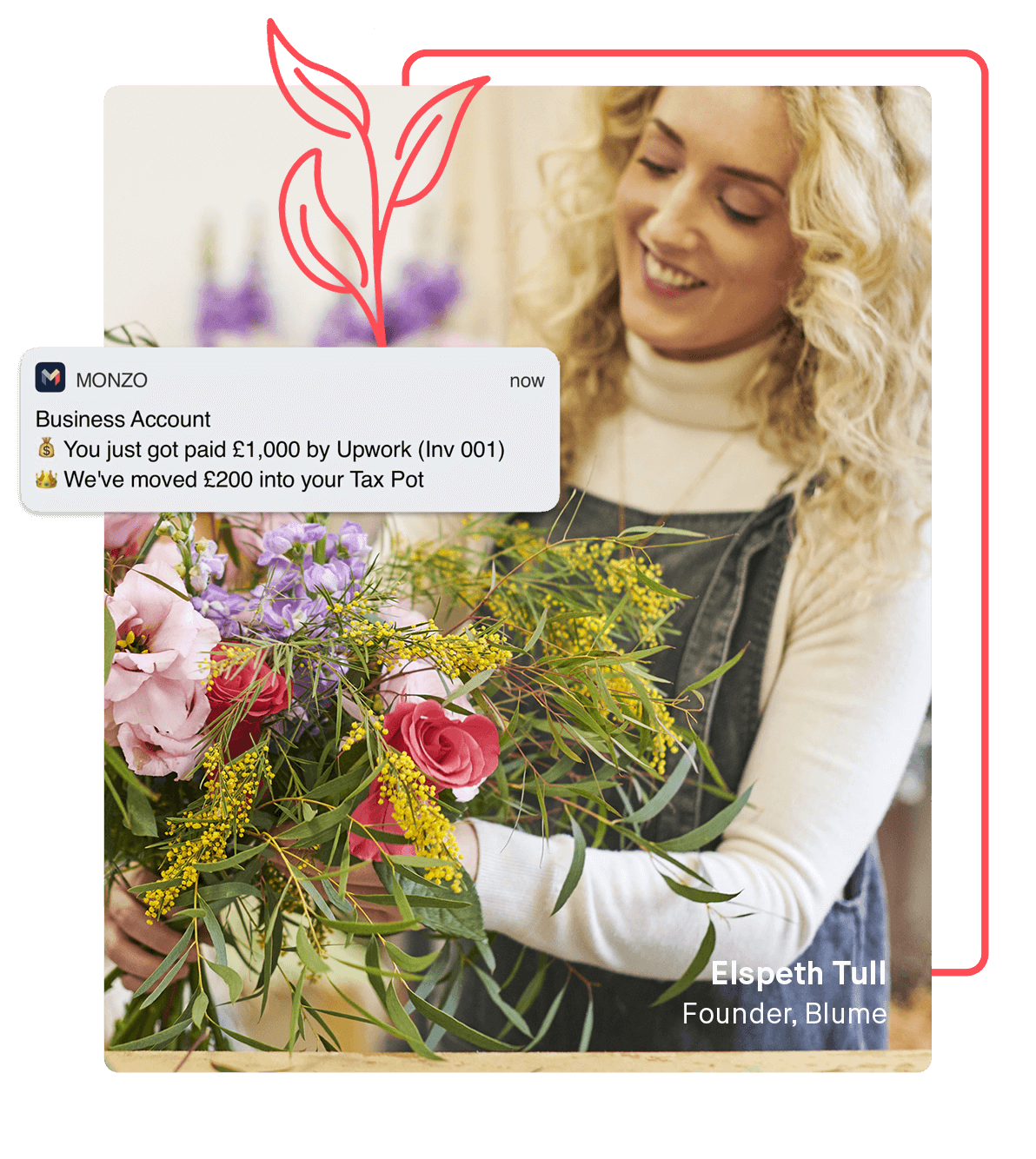

You can use things like Pots to set aside what you need for taxes 🎊

Set aside a percentage of your income automatically with Tax Pots, if you’ve got Business Pro

Choose a percentage to automatically set aside for tax, every time you’re paid. That way, you won’t have to manually shift money between accounts.

… Or use regular Pots with Business Lite to separate money from your balance

Ring fence a portion of your income or even schedule a regular transfer, all in one account. It’s the simplest way to make sure you’ve got the right amount when it’s time to take care of tax.

You can also integrate accounting tools if you’ve got Business Pro, so everything’s connected

You can sync with Xero, FreeAgent and QuickBooks, or export your transactions. That way, there’s no need to manually upload statements, and you’re using software that’s compatible with the government’s system. And if you’ve got a Business Pro account, you can get six months of Xero for free 🥳

If you’d like to learn more about Making Tax Digital, Xero’s resource hub for small businesses includes guides, webinars, videos and more to help you manage the process.