Managing your money after payday can be tricky. After spending weeks planning how you’re going to spend your salary, it can be tempting to impulse shop and go into full “treat yo-self” mode when it finally hits your account.

But there are few things worse than realising you’ve already burned your way through your wages by the end of the first week of a new month.

That’s why it’s worth taking proactive steps to make your money last the whole month, while also factoring in treats and enjoyable long-term priorities like holidays. It’s more sustainable to strike a balance between spending and saving, so you can enjoy your life now – and in the future.

So if you’re looking to change how you manage your money after payday, read on.

Decide your priorities for the month

Sit down and reflect on what you want to spend money on in the coming month. Maybe you’ve got a minibreak planned or a friend’s birthday, or perhaps you’re focusing on saving instead.

Even if you’re aiming for a frugal month, factor in enough spending money to help you find the right balance between saving and spending.

Plan your monthly spending

Once you’ve decided your priorities for the month, you can make a realistic budget. Find out where your money’s already going by grouping your spending into categories like bills, transport, personal care and family. And track how much you’re spending on each one.

Look at what you’ve spent money on recently and think – did you actually enjoy that thing? Was it worth the money? Or were you spending money out of habit or boredom? Working out what’s actually worth spending money on can help you cut back on the things you don’t particularly enjoy, which is cash you could put towards savings.

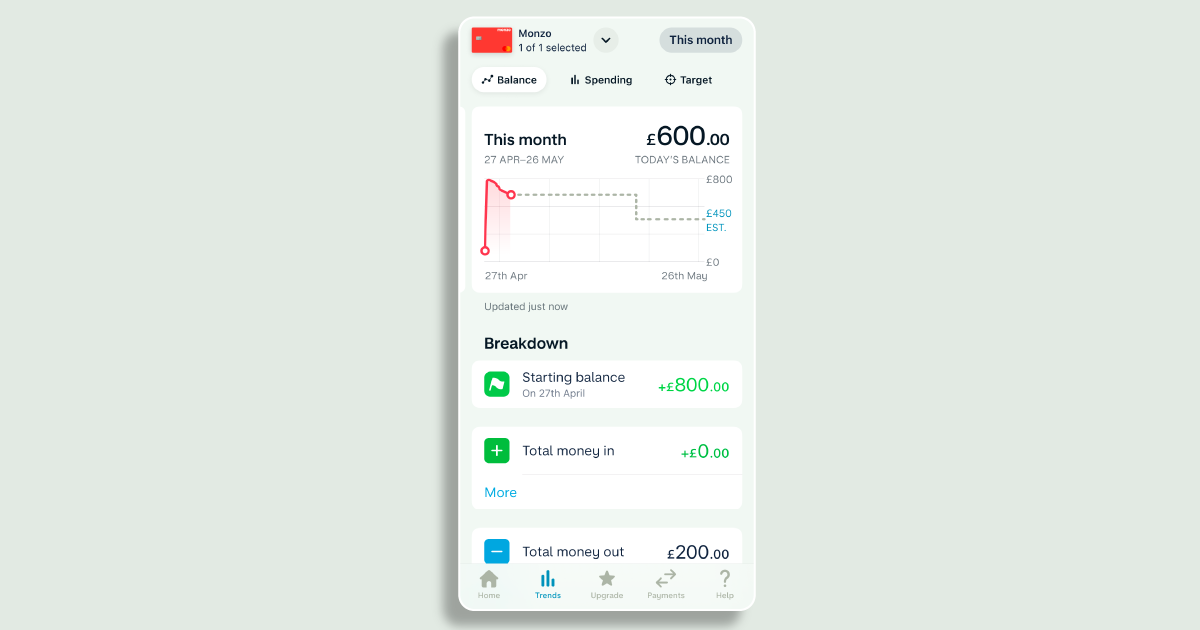

Use the ‘Trends’ tab to plan your spending from payday to payday.

Tap ‘Balance’ to see:

How much you started the month with

What’s come in

What’s scheduled to go out

What you’re saving into Pots

How much you have left to spend

For example, if you have £1,700 today but your rent and bills are £1,000 and due next week, you’ll have £700 left to save and spend on other things (not £1,700!).

Remember to set things up so your month starts on the day you get paid.

Pay yourself a regular allowance

Getting paid once a month can make budgeting tricky. If you have all your salary in your bank account, it’s hard to know how much you can spend every day or every week. And if you overspend at the start of the month, there’s a long time to go until your next payday.

Instead, you could pay yourself a weekly or daily allowance. It means you don’t have your whole salary available to spend in one go, and you’ll know exactly how much you can spend per day or week. Plus, even if you overspend too soon, you don’t need to wait as long until you get another chunk of money.

To do this, simply put all the money for the week or month into a Pot then schedule transfers into your current account.

Split your salary into Pots

Put all your money into Pots and only keep spending money in your main account. Use Pots to set aside cash to cover bills and put money towards your goals (like saving or paying off debt).

Pay for your monthly essentials – like rent, bills, subscriptions, council tax, etc. – before anything else each month. If possible, ask your providers to bill you the day after you get paid.

This means any money left over is yours to play with and you won’t be able to blow your rent on dinners and drinks.

With Monzo Plus and Premium, you can pay for things directly from a Pot – so your bills, subscriptions and other Direct Debits or standing orders can come straight out of the Pot and there’s no risk you’ll spend them.

Monzo Plus is £5 per month • 3 months minimum • Must be aged 18+ • Ts&Cs apply

Monzo Premium is £15 per month • 6 month minimum • Must be aged 18-69 • Ts&Cs apply

Sort your salary as soon as you’re paid

Use Salary Sorter to automatically sort your money into your Pots as soon as you get paid. Simply tap the payment once it arrives in your account and select Salary Sorter. You can remember these preferences when you’re paid from the same sender again, and you can always edit the amounts later.

For example, if you received a £1,700 payment, you could split the money between your rent and bills, savings Pots, spending money and/or anything else you’re saving for.

Pick a reasonable amount to sort into each Pot. Allocate yourself enough spending money, for example, so you don’t end up having to dip into your savings each month.

Plan for unexpected spending

Start a ‘Future You Fund’ (aka a sinking fund), or several, for unexpected expenses or irregular payments that are outside your normal budget.

This means each month you’ll have a Pot to dip into for friends’ birthdays, after-work drinks, spontaneous days out, or whatever else brings you joy.

Talk about your money goals with friends and family

If you feel like you’re having to spend beyond your means to keep up with the group, you’re probably not alone. Your pals might be trying to save some money too. Consider talking to your friends and loved ones.

If your nearest and dearest are in the same boat, you can hold each other accountable, support each other to reach your goals and celebrate your progress.