Become an investor and start building for the future, without having to do the hard work.

With Monzo Investments, you can pick from 3 ready-made investment options, based on the risk you’re happy to take. Then let experts manage the rest for you.

You’ll be able to grow your investing know-how as you go with bite-sized topics that help you learn key elements of investing.

And you’ll know exactly what you’ll pay, thanks to transparent fees.

Pick from 3 investment options

Choose from 3 ready-made options (known as funds) based on the risk level you’re happy with. The longer you plan to keep your money invested, the more risk you may be willing to take. (You can only choose 1 fund for each account.)

We purposely chose 3 funds so you could pick the option that suited you the most, without giving you so many choices that you felt lost – keeping it simple can help you focus on your long term goals.

Careful

You don’t want to take too much risk, so you’re happy with a potentially smaller return compared to what you might get with the other funds.

About 80% of money in this fund ends up in bonds, and about 20% in shares.

Balanced

You’re aiming for a higher return than Careful, with a medium level of risk. Your investment value could dip more compared to Careful too.

Roughly 34% of money in here ends up in bonds, and about 66% in shares.

Adventurous

You’re happy taking more risk if it means your returns could be higher. Your investment value may have more ups and downs than the other funds.

100% of money in this fund ends up in shares.

The value of your investments could go up or down and you could get back less than you put in.

Each fund aims to be 30% less carbon intensive

This is compared to similar funds that don't rule out investments for environmental, social, and governance (ESG) reasons. Not all their investments will meet ESG criteria.

Start small if you want

You can start investing with as little as £1 so you can build towards your future, even with the smallest investment. And you can add more anytime.

Think about turning on regular investing too. Regularly drip feeding money into your Pot could help you balance out ups and downs in markets that come along.

If you really need it, your money’s there for you to take too. But remember, the longer you invest, the more time your money has to grow.

Learn with each tap

We have all sorts of investing topics for you to delve into. Understand the difference between saving and investing. Find out more about what you’re investing in. And dig deeper into the meaning behind risk and return.

Each topic is packaged up into clear, jargon-free chunks. So you can tap away, learning as you go.

And if you’d like to dig even deeper into the intricacies of investing, there’s lots of other investing know-how in store for you in the app and on our blog.

Let experts take care of your fund

We’ve teamed up with BlackRock, one of the world’s largest fund managers, who already help millions of people invest for their future. So your money’s in expert hands.

BlackRock’s purpose is to help people experience financial wellbeing and feel more confident about their money.

They do this by offering ready-made funds to make investing easier and more accessible.

BlackRock’s aim is to help your fund grow in value over at least 5 years, taking a certain level of risk to do so. And they decide where to invest to achieve the fund’s aim. So you don’t need to do a thing.

Pay transparent fees

There’s no guesswork here. You’ll pay 0.59% of your investment value in fees (that’s a 0.14% fund fee to BlackRock and a 0.45% platform fee to us). If you had £1,000 invested, you’d pay 48p a month (if there was no growth or withdrawals).

Perks or Max customer? Then you’ll pay a lower platform fee of 0.35%. £1000 invested? You’d pay 40p a month (with no growth or withdrawals).

Your fees accrue daily, and are charged monthly.

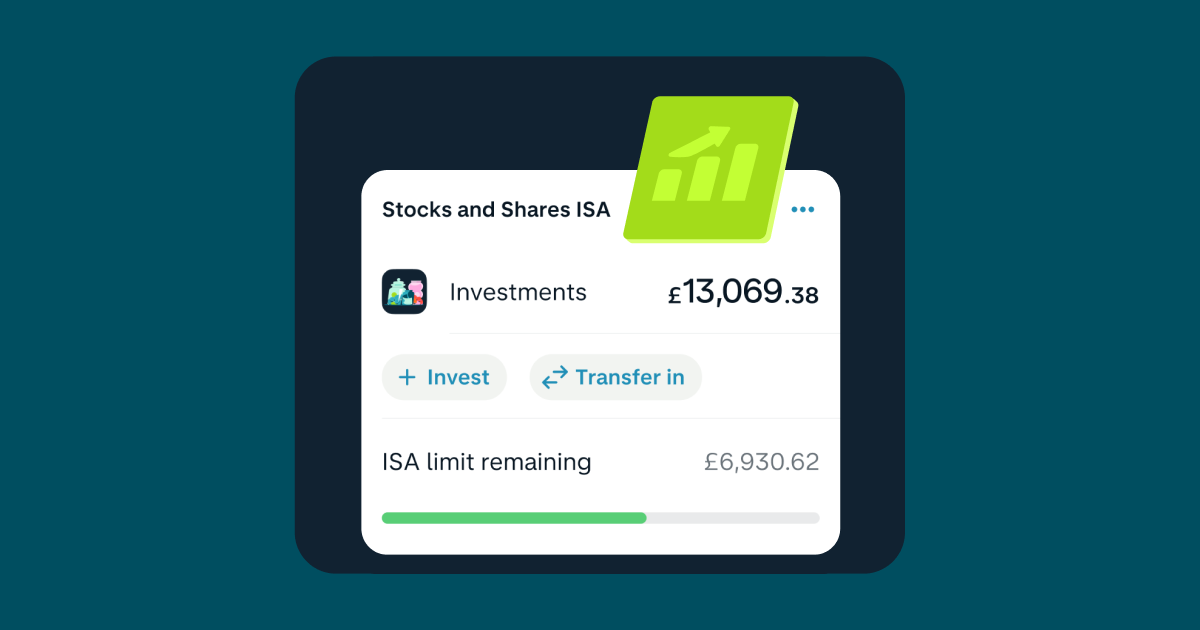

Bring your ISA over

Transfer your cash ISA or stocks and shares ISA from another provider over to us. It’ll give you a better idea of how you’re working towards your future goals and help you keep track of how everything’s doing.

Unless we offer the same funds, your other provider sells your investments and we reinvest the money. Depending on the investment price your provider has to sell at, your fund value could be worth less when it’s transferred.

Your Savings and Investments live together

We’ve built a home for your Savings and Investments to give you a clearer picture of how you’re progressing towards your goals that are days or a decade way.

How to get started

Here’s how to open an Investment Pot:

Go to Savings & Investments in the Home screen and tap Investments.

Choose to open an Investment Pot.

Follow the steps to choose an account and which fund you’d like to invest in.

Once you’ve accepted the legal documents, you’ll be able to make your first investment (and set up regular investing too).

And that’s it - you’re officially an investor. Now, let your money do its thing.

Find information on the 30% calculation in the fund prospectus, under each fund’s ESG policy. There's no guarantee that these aims will be met and the fund's carbon emission intensity score may change. The value of your investments could go up or down and you could get back less than you put in. This isn’t financial advice. If you’d like some, it’s best to speak to a financial adviser. iShares® and BlackRock® are trademarks of BlackRock, used under licence. BlackRock has no obligation or liability in connection with any product or service offered by Monzo. The information in this blog post is Monzo’s. BlackRock isn't responsible or liable for it, and they don’t guarantee it’s accurate, complete or reliable.

For more help on how to get started and FAQs, visit our Help Centre.

We’d love to hear what you think! Join the discussion on Twitter or Facebook, and share your feedback on the community forum.

Don't use Monzo yet? Give it a try today!

UK residents only, Ts&Cs apply. You need a Monzo current account to use Investments.