Monzo Premium has a new travel insurance provider

From 3rd July 2023, Monzo Premium’s worldwide family travel insurance will be provided by Zurich, powered by Qover. Most of the things covered by the insurance will stay the same. As will the excess amount and the price of Monzo Premium.

This blog explains more about the switch, including how Zurich’s own Terms and Conditions and Insurance Product Information Document (IPID) differ from the previous provider.

Why we’re making the switch

Our Premium customers told us that making a travel insurance claim wasn’t always as easy or as fast as it should be. So we decided to switch from our current provider to Zurich, powered by Qover.

By doing so, we can give Premium customers a better claims support experience from the Monzo app.

New provider, smoother experience

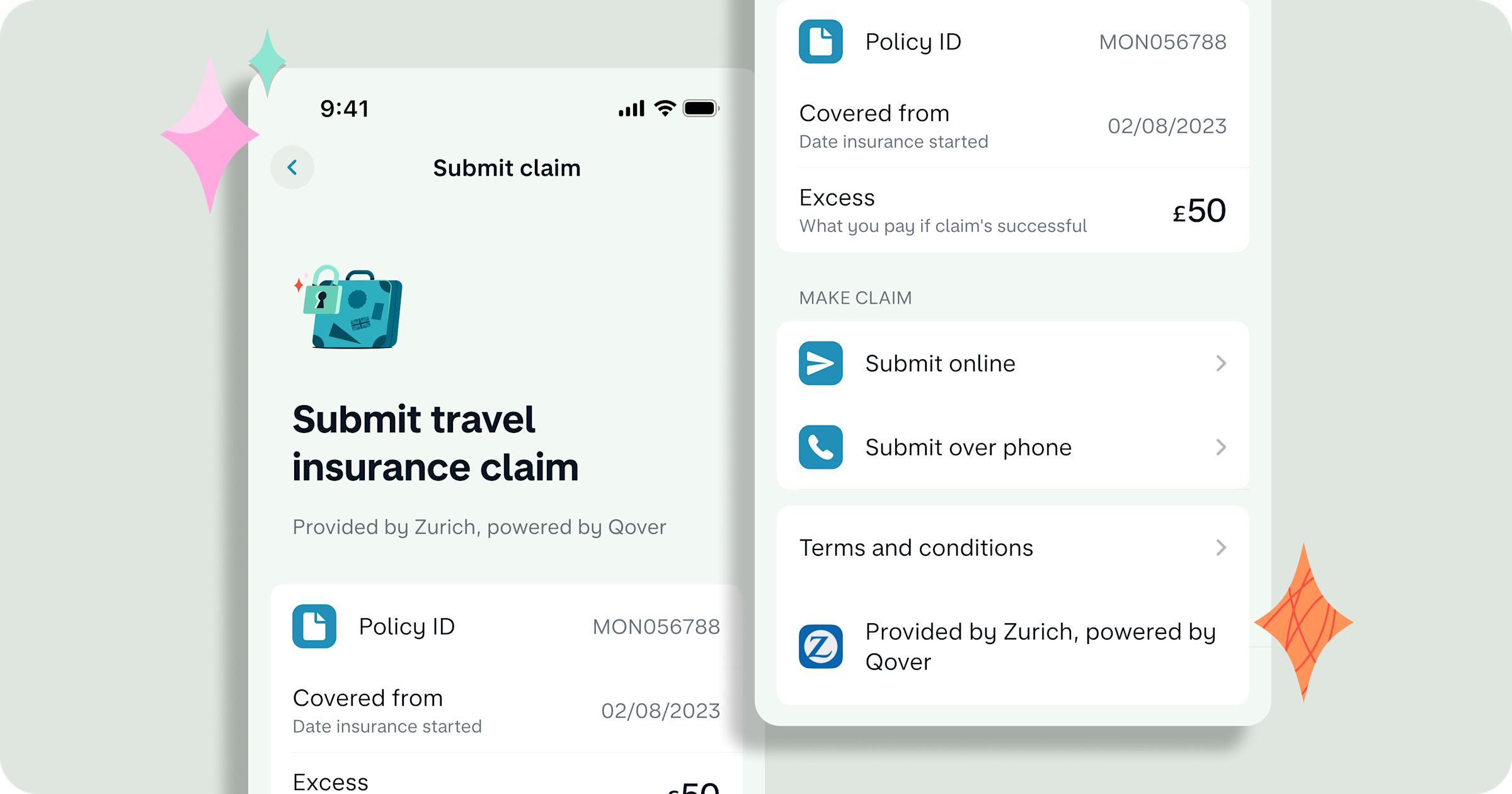

You can start a claim and request a travel certificate in the Monzo app. Previously, you had to call the travel insurance provider or use their online claims management portal to do these things. And in the future, you’ll be able to submit and track a claim in the app too.

A bit about the new provider

As of 3rd July, the new Monzo Premium travel insurance provider will be Zurich, powered by Qover.

Zurich Insurance Company will underwrite Monzo Premium’s travel insurance policy, meaning they're the ones who actually insure you. They will also arrange emergency help if you need it.

Qover will work with Zurich to deal with the claims you make and provide you with customer care.

Monzo Premium customers are still covered for these things

Most of the things that Premium customers are covered for today will stay the same. This includes:

Worldwide cover

Including the United States.

For you and your family

By “family”, Zurich means partners and dependent children up to 19 years old (or 21 if in full-time education). They’re only covered if they’re travelling with you. Exclusions apply, please read the Ts&Cs.

Multiple trips

You’re covered for an unlimited number of trips if each one is less than 45 consecutive days.

Winter sports

Including skiing and snowboarding, ski equipment and ski hire up to £750.

Travel disruption

Covers cancellation costs up to £5,000, costs for trips being cut short up to £5,000 and flight delays by 4 hours or more.

Car hire excess waiver up to £3,000

If you damage a rental car abroad.

Medical bills up to £10 million

For medical emergencies, including practitioners’ fees, hospital expenses and medical treatment.

Lost valuables up to £750

Including luggage, personal money and travel documents, jewellery, laptops and tablets, and more.

£50 excess

There's a £50 excess for every successful claim where an excess is payable. An excess is the amount of money you pay towards a claim. Limitations and exclusions apply. For full details of what is and isn't covered you can refer to the Terms and Conditions.

New provider, new terms and conditions

The change in provider means that Zurich, powered by Qover will be setting their own exclusions. We’ll also be changing some of the language in the Monzo Premium Terms and Conditions.

If you’re a Premium customer, here's a summary of the things that will be different in your new Zurich policy:

General exclusions now include climbing on roofs and jumping from heights, buildings and rock formations.

You’ll now need receipts for all claims.

Personal liability now excludes intellectual property and copyright, loss or damage to property, and any damages that should be more specifically claimed under another policy.

Hijack now excludes privately chartered or rented vessels.

Winter sports now excludes claims for anything you've left unattended, unless in locked storage or a lockable ski or snowboard rack.

If you’d like to find out more, we recommend you read the Zurich Terms and Conditions in full.

If you’re already a Monzo Premium customer

If you’re a Monzo Premium customer and wondering how the switch will affect your travel insurance cover, here’s what you need to know.

Up to 2nd August 2023, AXA will provide your travel insurance cover then we’ll move you over on 2nd August 2023 and update the ‘your travel insurance’ section of the Monzo Premium Terms and Conditions. There’s nothing for you to sign and no forms to fill in. And there’s still no need to make any medical declarations. Please note, pre-existing medical conditions are not covered.

Rest assured, there’s no period of time when you won’t be covered for eligible claims.

If you have an existing claim with AXA it will continue to be processed by them in line with your current AXA policy Terms and Conditions.

Monzo Premium: banking that makes a statement at home or abroad

Monzo Premium gives you the best of Monzo in one white metal card. We’ve packed benefits like phone insurance from Assurant and worldwide travel insurance for you and your family when they’re travelling with you. That way, you’re always ready, whether you’re home or on holiday.

You can also earn interest on up to £2,000 in your balance and Pots (including Instant Access Savings Pots, but not Pots from partner banks), and access to so much more.

You need to be aged 18 to 69 to sign up for Monzo Premium. If you have a Monzo or Monzo Plus account you can upgrade to Monzo Premium, if you’re eligible. Take a look at the terms and conditions for full details.

Completely new to Monzo? Download the app here.