Switch to Monzo Business

The Current Account Switch Service means moving everything from your old bank over to Monzo Business is a breeze.

Only sole traders or limited company directors in the UK can apply. Ts&Cs apply.

What’s the Current Account Switch Service?

The Current Account Switch Service is a not-for-profit organisation that lets people move quickly and easily between bank accounts. We’ve teamed up with them so it’s painless for you to switch your business account to Monzo.

You're covered

The Current Account Switch Guarantee covers full switches, so if anything goes wrong you won’t be left out of pocket. And we’ll make sure any payments to your old account always make it to the right place, even after your old account is long gone.

Open a Monzo Business Account

To use the Current Account Switch Service, you first need to open a Monzo Business Account. Get started today, and switch hassle-free.

Switch to Monzo hassle-free

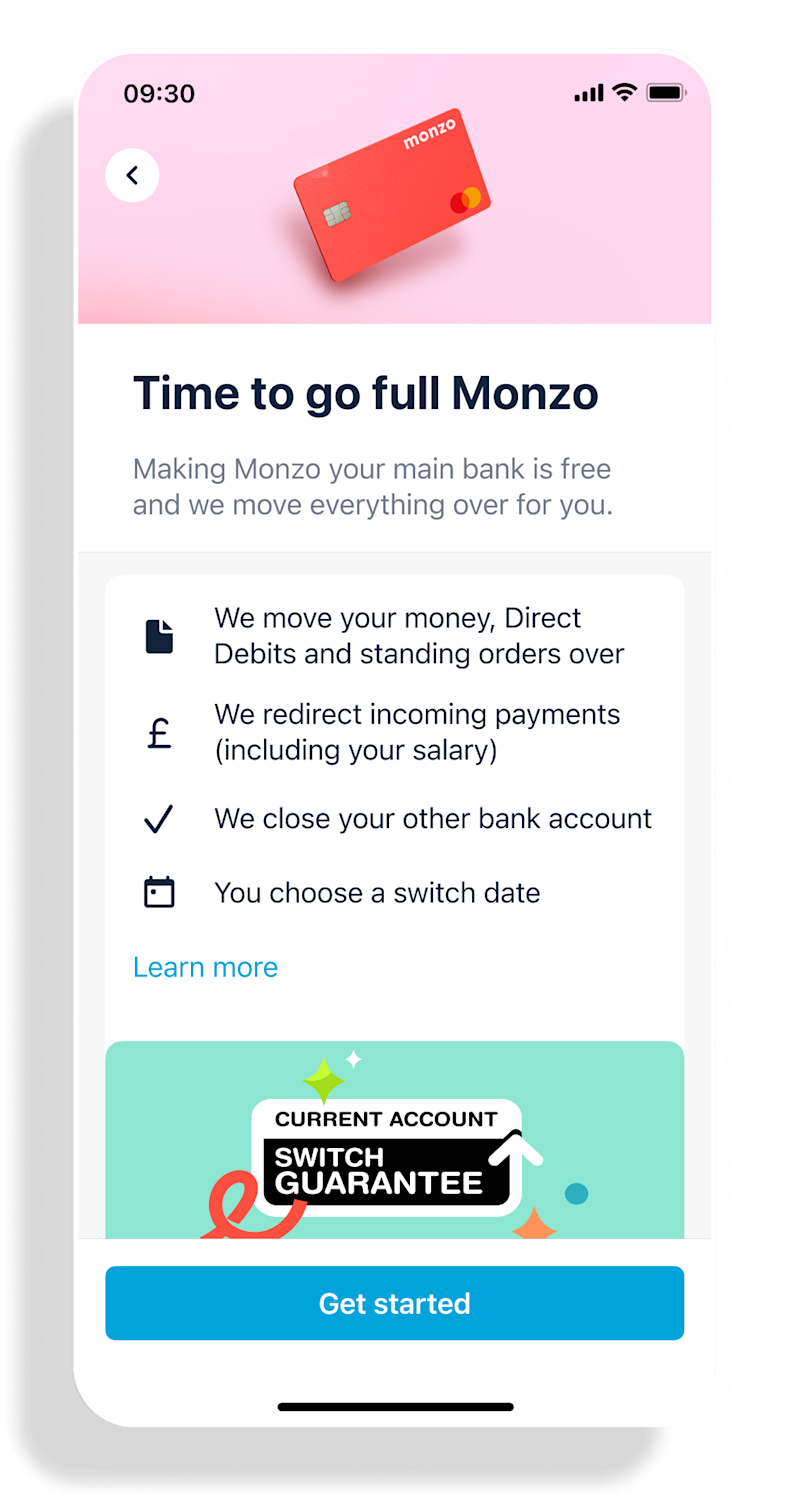

No trips to the bank. No messing with ID and statements. You just need to open a Monzo Business Account and tell us when you want to move, and we'll do the rest in 7 working days.

Move your whole account

Once you start a switch from the app we’ll move all your money and payments (like Direct Debits and standing orders), and close down your old account for you.

Want to switch?

Once you have a Monzo Business Account, you can switch right from your app. Before you start, make sure that all the details on your old account are up-to-date and match those on your Monzo Business Account.

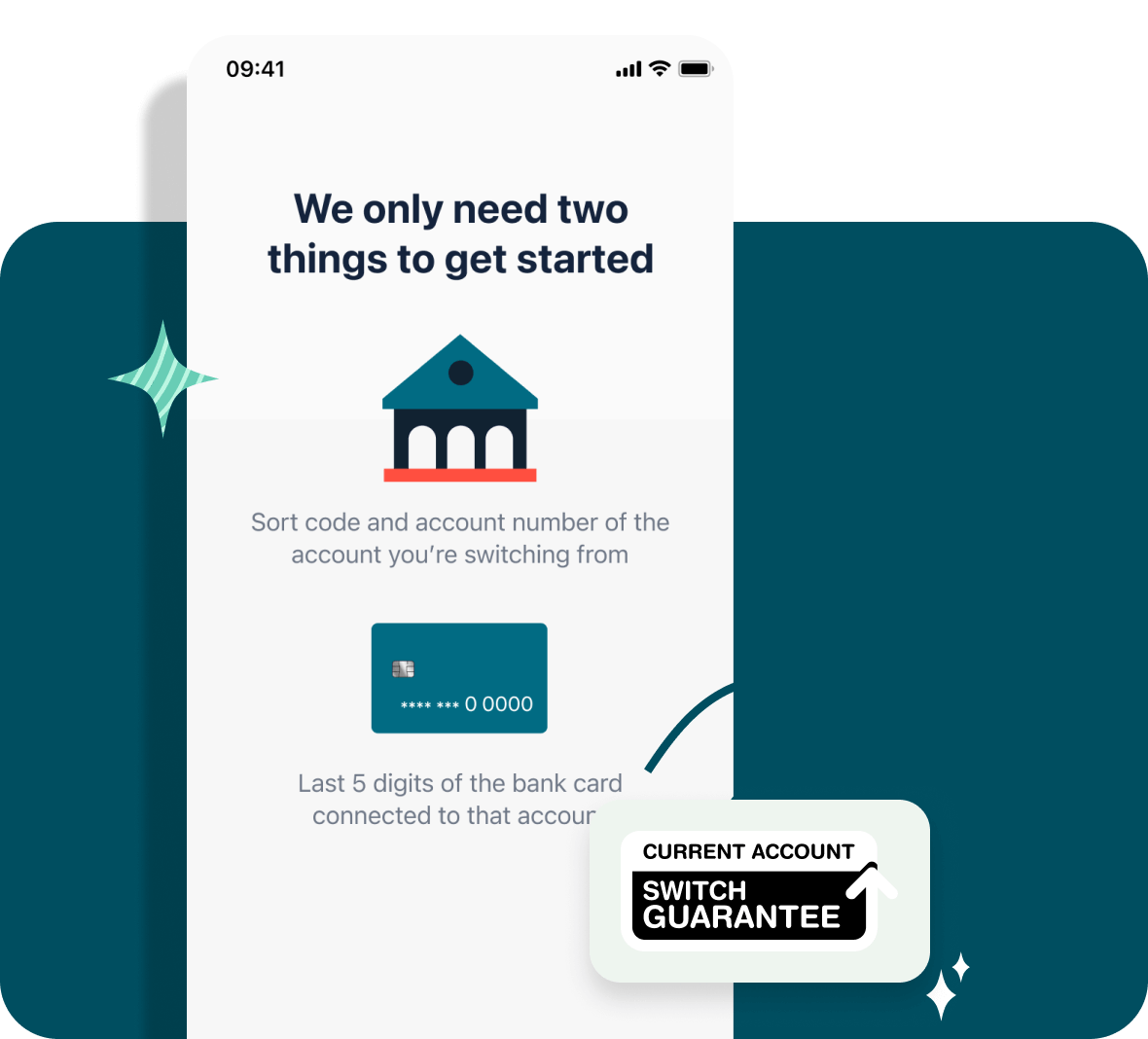

Follow these steps:

Head to your Account in the app

On iOS, tap on your name. On Android, tap the Settings icon

Tap “Switch to Monzo” and we’ll guide you through your switch

Third Party Provider permissions

If you've given permission to third-party providers (like payment services, money management apps or financial comparison sites) to make payments on your behalf or access any of your data, that access won't transfer automatically when you use the Current Account Switch Service to switch to Monzo.

If you want to bring access to the same services across with you will need to:

Cancel and re-authorise these with your new account details.

Contact the third party providers directly to discuss arranging set up at your new bank

Check which third-party provider permissions you have on the old account before the account is closed. Make a list of the ones you want to keep.

Once your switch to Monzo is finished, follow the third-party provider instructions on how to update your details.

Please bear in mind that not all third-party services are supported by all banks and building societies, so you might not be able to keep using all the same services with your new account.

Current Account Switch Guarantee

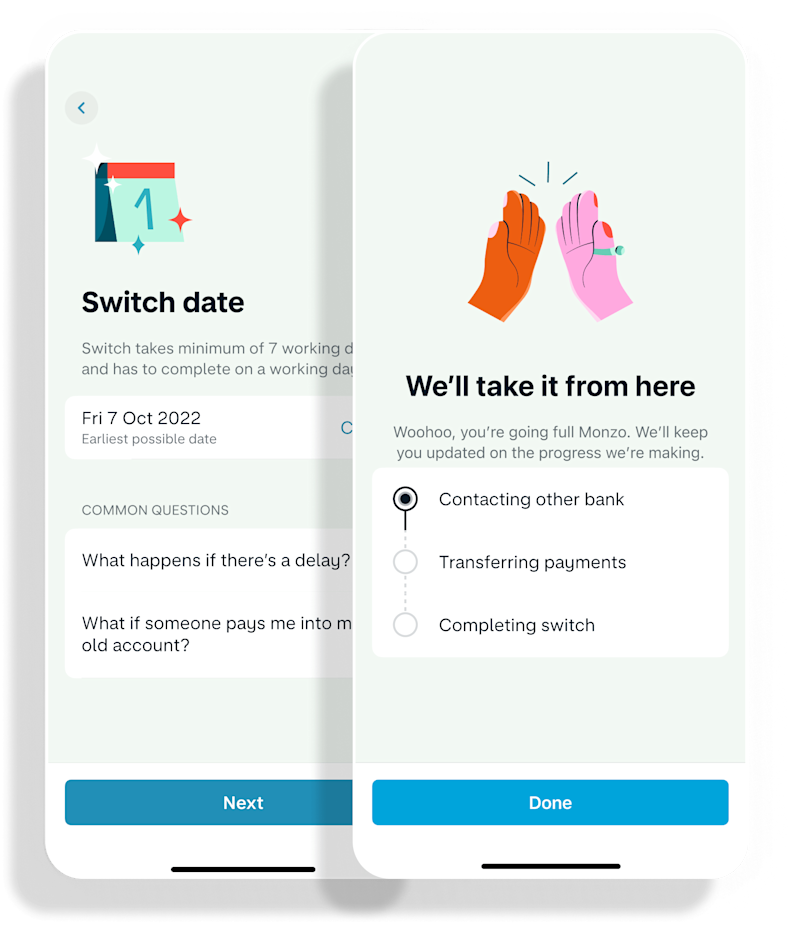

The Current Account Switch Service has been designed to let you switch your current account from one bank or building society to another in a simple, reliable and stress-free way. It will only take seven working days. As your new current-account provider we offer the following guarantee.

The service is free to use and you can choose and agree your switch date with us.

We will take care of moving your payments going out (for example, your Direct Debits and standing orders) and those coming in (for example, your salary).

If you have money in your old account, we will transfer it to your new account on your switch date.

We will arrange for payments accidentally made to your old account to be automatically redirected to your new account. We will also contact the sender and give them your new account details.

If there are any issues in making the switch, we will contact you before your switch date.

If anything goes wrong with the switch, as soon as we are told, we will refund any interest (paid or lost) and charges made on either your old or new current accounts as a result of this failure.

Useful information

Overdrafts

You may be able to include an overdraft as part of your switch when using the Current Account Switch Service. If you’d like to have an overdraft with your new bank account, speak to us before starting your switch and we will be able to advise if you’re eligible.