You’re already sharing your Netflix login and you’ve decided you want to share finances. Now what?

A joint account can be a great way for couples, family members, or even roommates to manage their finances together. A joint account is a separate account you share with someone you know.

It works the same way your personal account would - make payments, deposit your paycheck, or sort your money into Pots - while keeping things separate and organized.

If you don’t already have a Monzo account, you can sign up in less than 10 minutes on your smartphone.

Both you and your account co-owner will have personal Monzo accounts as well as a combined joint account.

Get started with your joint Monzo account

1. Start your joint account application ⭐ From the Home screen, tap your profile photo in the top left of the screen. Scroll down and tap “Open a joint account”. Answer a few questions and invite your account co-owner to open the account with you. If you received a joint account invite, you’ll also need to answer a few questions to finish your part of the application.

2. Add your card to your digital wallet 📱

Once your joint account is open, you don’t have to wait until your physical card arrives to start using it! Add it to your digital wallet and use your card with Apple Pay or Google Pay right away.

3. Fund your joint account 💰

You can instantly move money from your personal Monzo account into your joint account.

Alternatively, you can connect an external account and transfer money to your joint Monzo account. Your joint account co-owner won’t see the accounts you’ve connected but will see the money you add.

You can also set up your direct deposit to go right into your joint account, or even split it up between your personal and joint accounts. Your personal and joint accounts each come with their own account numbers, so you can choose how much of your paycheck goes to which account.

Plus you’ll still have the same great features like Salary Sorter to sort your paycheck into different Pots to make sure you have enough set aside for bills and groceries.

4. Set up shared Pots to manage your budget together 🍯

Just like your personal account, you can set up Pots in your joint account too. Pots allow you to divide up your money within the same account, making it easy to set aside enough money to pay bills and save for goals.

5. Move bills or committed spending over to your joint account 💡

Maybe you’ve got shared household bills like electric or Internet bills. Instead of being individually responsible for different bills and calculating who owes what every month, pay your bills directly from your joint account instead.

6. Manage your money as a team 🤗

Now that your joint account is set up, start managing your finances together!

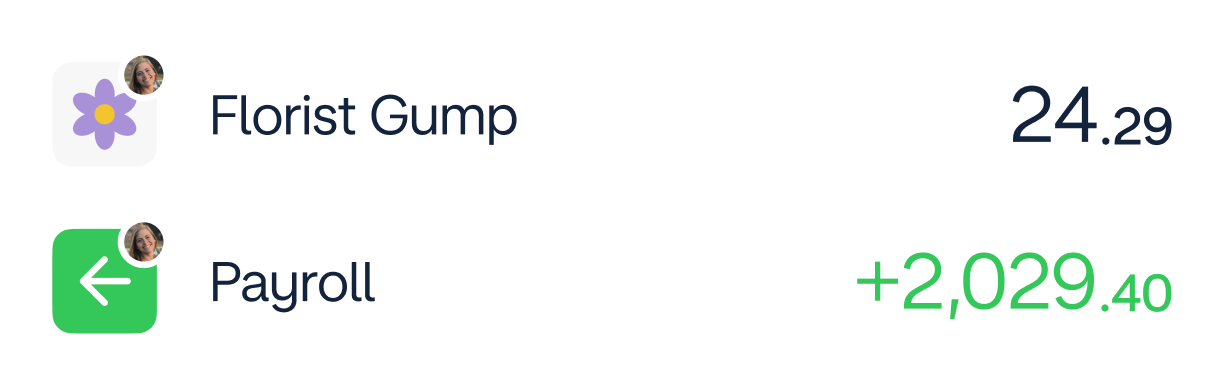

Each transaction is shown in a single feed and tagged with your profile photo so you know who spent what and where. Instant spending notifications also show the name of who made the transaction.

Making the most of your money is about being organized. We’re here to help you stay on top of your shared expenses and make sure you’re both on the same page when it comes to managing your money.

Ready to manage your finances together?