Earn 3.75% APY on your savings with Monzo

No catch, no small print. Just instant access savings with a rate 8x better than the national average.*

Banking services provided by Sutton Bank, Member FDIC, pursuant to a license from Mastercard International Incorporated.

Smart tools to supercharge your savings

You set a savings goal, and we'll help you get there. We'll work out what you need to contribute and set up automatic deposits.

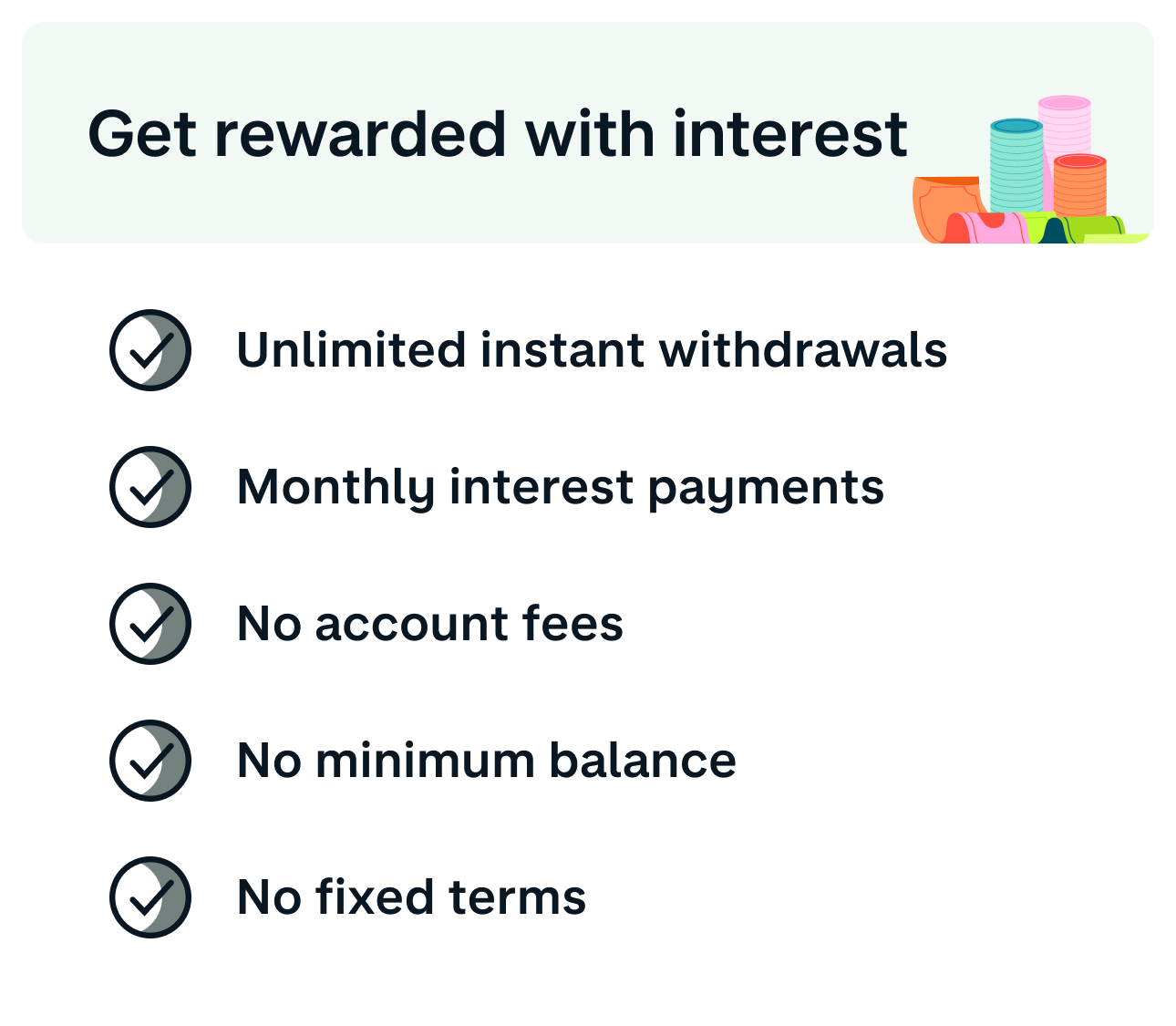

Start small with no catch

No fees, no minimum deposit, and you can withdraw your money instantly whenever you need it.

The security of a fully regulated bank

Your money is FDIC-insured up to $250,000 across all of your accounts and held by a regulated bank.***

And since we don't bury the footnotes

* What’s the national average interest rate?

The national average interest rate for savings accounts is 0.42% as posted on FDIC.gov, as of December 16 2024.

** How does FDIC insurance work? Your funds are held at Sutton Bank, Member FDIC. Monzo is a financial technology company, not a bank or FDIC-insured depository institution. Monzo accounts are subject to pass-through FDIC insurance up to $250,000 per ownership category, should Sutton Bank fail. Certain conditions must be satisfied for pass-through FDIC deposit insurance coverage to apply, which you can learn more about here.