New Year, New Budget

2022 is just around the corner, so it's the perfect time to set some New Year’s resolutions, get your finances in order, and make a plan for the year ahead. In this article, we’ll walk through 7 easy steps to help you set (and stick to) a budget for the new year.

1. Think about what you want to achieve in the new year 💡

What big things do you want to achieve over the next year? Are there big events or purchases that you want to save up for? Setting clear goals is key to motivating your finances – whether it’s moving house, starting a family, or changing jobs!

2. Review your current finances 👀

Before you get started with a new plan for next year, review the current state of your finances. List out your sources of income like salary and side hustles, and your expenses like rent, monthly bills, taxes, and other living needs. Ideally, try to centralize your money in and money out transactions in one place for easier budgeting.

3. Put aside time on your calendar 📅

You’ll need to carve out some time to make a plan for the new year. You’ll also want to put some time aside on a regular basis to make sure you’re sticking to your plan. We recommend putting aside 30-45 mins every few weeks to review how you’re doing with your plan.

4. Write a budget 📝

The next step is to think through your monthly budget. You’ll want to put your income on one side, with your regular outgoing expenses on the other side. Make sure you include fixed expenses such as rent, mortgage, loan repayments, and a realistic estimate for expected variable expenses such as food or utilities.

The difference between those two numbers is what you can put into savings each month. Is that enough? Perhaps you need to make changes to your budget to save enough to achieve the goals you set in step 1.

5. Consider paying off or reducing your debt 📉

Depending on your situation, you may want to prioritize paying off any loans ahead of any savings. In particular, you might benefit from refinancing or consolidating your loans in one place.

6. Start saving! 💰

Once you’ve set up your budget, you want to set aside money on a schedule that works for you. This is where automation can really help. For example, creating an automatic deposit from your checking to your “vacation” savings.

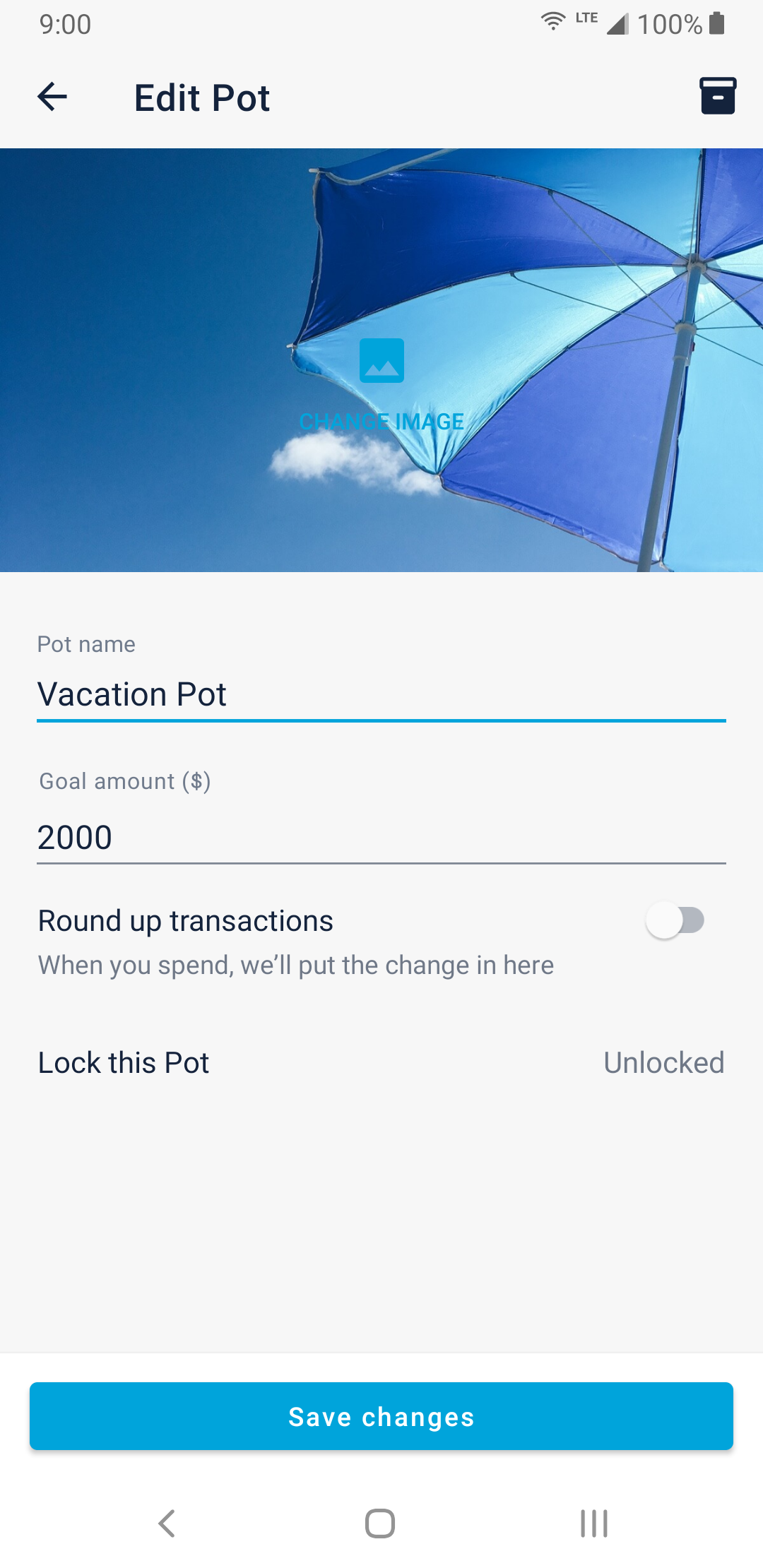

Monzo customers can use the pots feature to make saving easy. It’s easy to set up recurring payments to and from pots, or turn on round-ups to automatically set aside the change from each card transaction.

Be sure to save for an emergency fund too! We recommend saving 3-6 months worth of expenses in your emergency fund.

7. Keep track of day-to-day spending 📊

Small purchases quickly add up. To stay within your budget, you’ll also need to keep a close eye on day-to-day spending. However, you also need to be realistic – there’s no point in planning a budget in January if it’s too difficult to keep track of by February.

Keep an eye on your Monzo Summary tab to track spending month-to-month. It’ll help identify areas where you can reduce your spending and let you set a budget for individual categories.

Stay tuned for upcoming Monzo feature releases! In early 2022, we’ll launch new features that’ll help you keep track of spending across your entire financial life, whether it’s at Monzo or any other financial institution.